According to a study by the French consultancy AgileBuyer and the Conseil National des Achats, the following trends have been observed in France. They mark a fundamental evolution that is also valid for other countries in Europe, including China.

Extract from the Executive Summary of this study

- A much stronger desire to relocate in Europe and in France

In 2022, crises will push 47% of purchasing departments to relocate. This is 17 points more than in 2021. Although price remains a barrier (13% in 2022 compared to 18% in 2021), it is above all difficult to buy French because certain products are not available in France (for 30% of respondents). In 2022, the areas where purchases will be relocated will mainly be in Europe (80%) before France (72%).

- A crisis marked by shortages

In 2022, 68% of companies will be faced with shortages. Shortages are to be found in strategic sectors such as the automotive industry (78% of respondents) and mechanical engineering/metallurgy-furniture equipment and textiles (75%). These shortages have had a strong impact on company margins according to 65% of respondents.

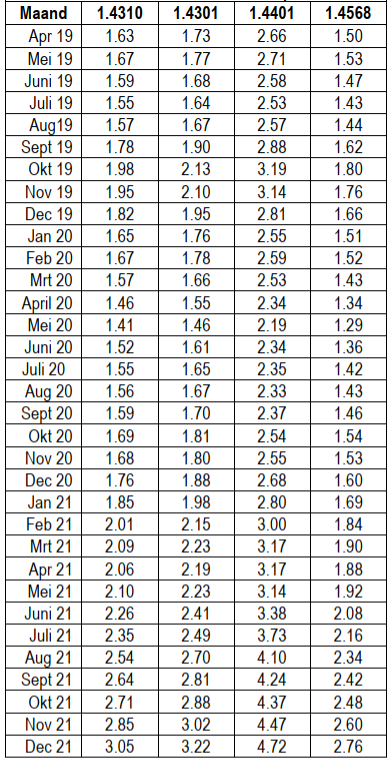

- Metals, raw materials and electronics top the list of shortages

Metals (23%), raw materials (excluding metals and chemicals) (17%) and electronics (14%) top the list of shortages identified by purchasing managers. This is closely followed by IT (13%) and transport (12%). Thus, the lack of semiconductors has a strong impact on production in the electronics and IT sectors, but also in the automotive sector.

- Securing supplies is still a topical issue

82% of purchasing departments will implement actions to secure supplies in 2022, compared to 74% in 2021. Continuity and security of supply are considered more important for 2022 for 45% of purchasing departments.

In this context, the Plate Spring China Inc, thanks to its in-depth sectoral knowledge of the sectors most affected by this fundamental trend, its policy of closely monitoring the evolution of raw materials (see our various points on /fr/actualites/), its policy of anticipating purchasing needs in order to meet the forecasts of its customers, its mastery of materials (/fr/matieres-finitions/) and its broad technical capabilities, can help its customers to respond quickly and solidly to the supply challenges they face.

With over 20% of its turnover from civil engineering machinery, forklift & industrial vehicle, The Plate Spring China Inc has extensive expertise with global and European leaders in these industries.

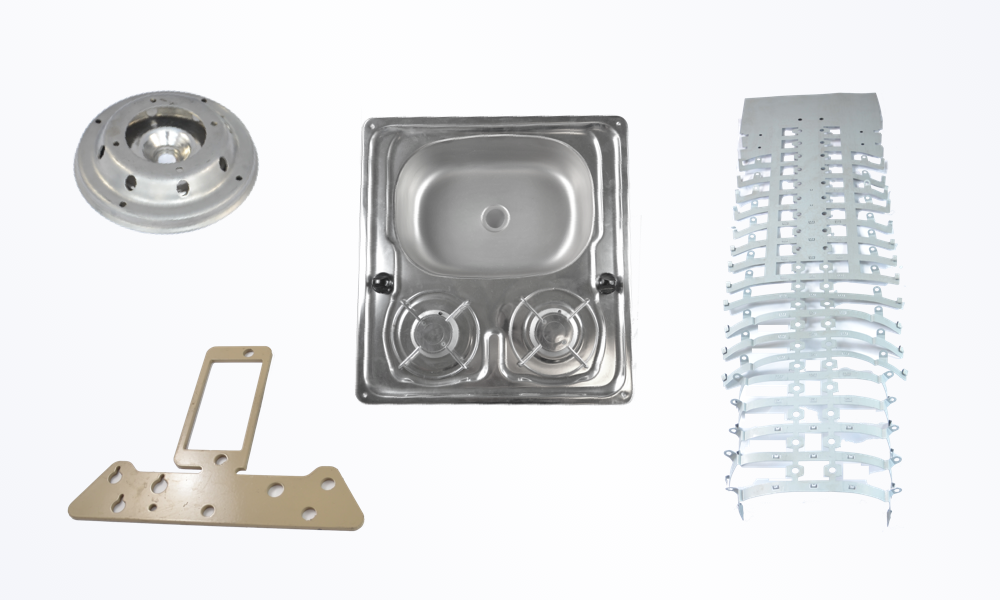

For this sector, Plate Spring China mainly manufactures a set of laser cut parts or mechanical press (shim, washer) and a set of sheet metal parts and welded assemblies. The Plate Spring China Inc masters the wide range of the control and exigence systems needed for clients such as Caterpillar.

From the unit to several million pieces, Plate Spring China offers a comprehensive solution. Whether you are in a planning phase and need our expertise or already have your final plans and specifications, we are here to help you.